FXCM Reviews and Comments written by Real Forex Traders

Contents

The forex broker is licensed and regulated by the Financial Conduct Authority . Regulated and supervised brokers won’t influence market prices. Once you submit your withdrawal request to FXCM, they will honor it. FXCM doesn’t provide any extra fortification through a private coverage firm. 74.74% of retail investor accounts lose money when trading CFDs with FXCM. FXCM offers access to trade following assets on MetaTrader 4 and Trading Station.

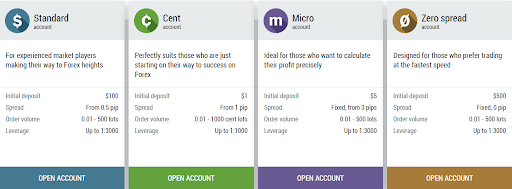

FXCM caters to most traders from its CFD account type, with the primary difference being by regulatory jurisdiction. I rank trading costs among the most defining aspects when evaluating a Forex broker, as they directly impact profitability. Friedberg Mercantile Group Ltd. (“Friedberg Direct”) is an independent legal entity and does not own, control or operate this third-party website. Select your country of residence and desired trading platform to get started.

Commissions and fees

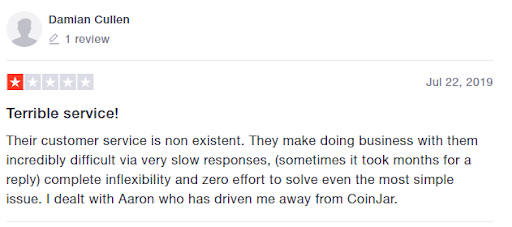

Friedberg Direct offers a transparent pricing model, made up of low, competitive commissions and super-tight spreads. A trader has to pay a price for Forex in the United States in the restrictions placed for the regulations but FXCM is absolutely safe and trustworthy. They don’t have an Service Level Agreement so I would not recommend anyone to deposit funds with them. I just wonder if I would ever be able to withdraw funds from them.

If you are nursing any doubt or fears about the platform, then reach out to customer support and lay your complaints or challenges. One other fascinating feature on the mobile platform is the prompt notification offered. Many mobile platforms out there will allow customers to pre-set notifications for prices, margin levels, and market conditions. These alerts will help traders know when to enter the market and when to exit a trade or increase their trading investments. Forex analysis and charts are essential tools to assist traders on the FXCM platform in understanding the volatility of currency prices and when to attempt trading such as selling or buying currencies.

It is under the regulation of international licensing companies. Traders get to trade on simple platforms that offer one of the best qualities while trading. These and many other things are the advantages that come with the broker. After you have created your trading account and verified it so you can start using your live account, you will need to deposit money into the account before starting trading on it. Don’t worry because the process of funding your trading account is easy. When you do, the next page will be where you have to select a payment method.

The range of products available to you will depend on which global entity under the FXCM Group houses your trading account. The following table summarizes the different investment fxcm review products available to FXCM clients. With the TradeStation, you get access to financial news, education and research material, analytics, and professional charting.

What trading platforms does FXCM offer?

66% of retail investor accounts lose money when trading CFDs with this provider. 67% of retail investor accounts lose money when trading CFDs with this provider. FXCM is an excellent solution for beginners and experienced traders alike.

A forex industry expert and an active fintech and crypto researcher, Steven advises blockchain companies at the board level and holds a Series III license in the U.S. as a Commodity Trading Advisor . As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. FXCM’s pricing for forex trading is slightly higher than the industry average. Although a wide variety of third-party platforms are supported for algorithmic trading, MetaTrader 5 is not available at FXCM. FXCM is a leader in algorithmic trading solutions, whether you’re a beginner using Capitalise.io or an advanced coder using Python.

Gain insights from each trade’s extensive and detailed facts. With the press of a button, you may modify your plans based on their results. Use the Capitalise.ai app on your iPhone or Android to manage your trades on the fly; edit, halt or automate new trading methods. Like forex and crypto, you should have an account with the broker.

FINAM FOREX Review

For proof of residency, the broker requires the traders to take a picture of a utility bill. The form contains the traders’ full name, phone number, email address, birthday, and password. Traders should fill this place with the correct information to avoid any trouble later in the future, such as having their accounts not successfully created. This means that even if anything were to happen, the broker would have to pay the clients their money, as what affects the company’s fund does not affect the clients. FXCM follows what is called “CASS.” CASS is a mandate that makes the company to payback clients if anything happens to their fund.

FXCM provide CFD trading, which allows you to trade the price movements of currency, stock indices and commodities like gold and oil without buying the underlying product. When you trade CFDs with FXCM, you can speculate on price between when you open and close the CFD. The difference in price is the profit or loss, minus any broker fees. FXCM offer many different platforms to suit your trading needs, including the popular MetaTrader 4 platform and their very own proprietary Trading Station. When you open an account with FXCM, you can choose to trade from any platform which is great. It means you can seamlessly access and manage your account across all platforms depending on what is most convenient for you at the time.

- They proudly offer access to a suite of award-winning algorithmic trading tools and services.

- Users can use these reports to perfect their trading skills.

- Trading signals can be used in isolation or as a complement to nearly any strategy.

- Overall, FXCM’s research is a touch above the industry average and will satisfy most forex traders, though it’s not as rich or diverse as what’s offered by the best brokers in this category.

For example, the typical spread for the UK100 is just 1 pip, and the spread for the US2000 index is just 0.43 pips. Furthermore, CFD traders have the option to either go short or long by speculating on the potential price movements of the underlying asset without actually owning it. FXCM clients also have the opportunity to choose from top-rated online platforms https://forex-reviews.org/ such as Trading Station, and MetaTrader 4. Everything that you find on InvestingBrokers.com is based on information and data that is readily available from each broker that we have reviewed. We combine our 15+ years of industry experience with research, analysis and user feedback. This enables us to give an impartial and reliable broker rating.

Non-trading fees

It can be a useful tool to help gauge in which direction the market may be heading. The FXCM economic calendar highlights worldwide economic events that have an impact on trading instrument prices. You may look up events and compare analyst consensus to historical data. The worldwide market news is updated multiple times during the day. It provides the most recent news and events in the economic activity of many nations.

Friedberg customer accounts are protected by the Canadian Investor Protection Fund within specified limits. A brochure describing the nature and limits of coverage is available upon request or at Trade your opinion of the world’s largest markets with low spreads and enhanced execution. The requirements are that you have an existing FXCM trading account and that you meet a minimum notional volume bracket of at least $10 million per month.

FXCM offers an economic calendar, and using the demo feature; one can test the difference in the expected value and the actual value to develop strategies for real trades. Experienced traders and professionals can also use this demo feature to try different trading strategies. FXCM provides a respectable variety of market research from a combination of in-house content and third-party materials. Overall, FXCM’s research is a touch above the industry average and will satisfy most forex traders, though it’s not as rich or diverse as what’s offered by the best brokers in this category.

The research portal has a basic set of trading tools like financial calendar, diurnal technical levels, and third party market apprises. But, the gravity of innovative and standard fundamental analysis is below the usual, with fewer macro and internal market resources. 67.7% of retail investor accounts lose money when trading CFDs with this provider.

Crypto CFD Trading

When investing in crypto CFDs with FXCM, the trading fees are included in the spread and there are no commission fees when opening and closing positions. Trading cryptocurrency CFDs with FXCM appeals to many traders as they can control their position sizes with small contract sizes. For example, a single contract of BTC/USD at FXCM is the same as one percent of the underlying price of Bitcoin. Expert Advisors are automated programs that are used to manage and trade financial markets based on sophisticated trading algorithms. As we have already discussed FXCM only provides access to CFD and forex trading. So, let’s take a look at the markets and products you can access when trading with FXCM.

FXCM Group has been in the commodities and currency trading industry since 1999. FXCM is presently owned by Jefferies Financial Group, which is listed on the New York Stock Exchange. After the submission of the online form, the FXCM team will verify the user details. And once this is done, the registered users will receive an email sharing their MyFXCM username and password. We tested it and collected the options and costs in How to withdraw money on FXCM.

Forex is a good instrument if you want to add it to your investment portfolio. Not all brokers separate the clients’ funds from their own. This often brings confusion and distribution of clients’ trading abilities.

Place your holding position on the market chart and the amount you want to place the trade with. After choosing the position and the amount, you want to open the market with, set the time the trade will last. After logging in, what you need to do is to fund your trading account with an amount.